Hedge Fund Index Performance vs. the S&P 500

- Font Size:

- Print

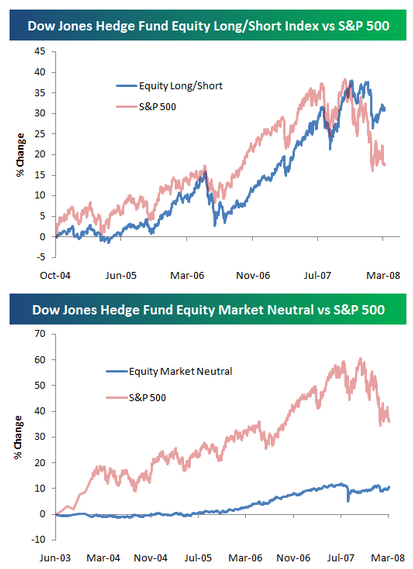

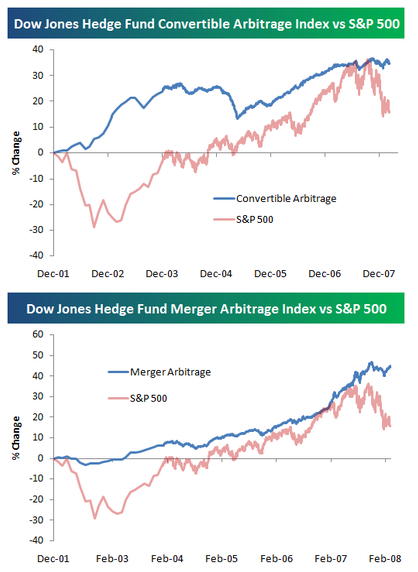

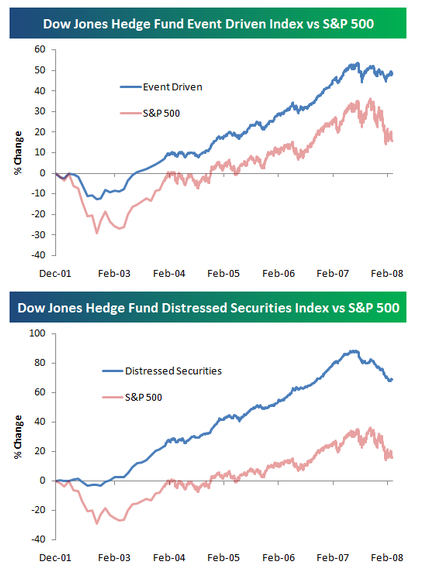

For those interested, below we provide the historical performance of various Dow Jones hedge fund indices versus the S&P 500 over the time period in which they've been around. All but one hedge fund strategy has beaten the S&P 500 since its inception.

The equity market neutral strategy is the only one underperforming the S&P 500. This strategy effectively has no exposure to the market because its shorts and longs are supposed to cancel each other out. Distressed securities, convertible arbitrage, merger arbitrage and event driven strategies have all done well versus the S&P 500 and have continued to hold up well during the recent market declines.

Not surprisingly, the equity long/short strategy, which was performing relatively inline with the S&P up until the market peaked last year, has also outperformed the market during the current downturn.